Agent+Defi Model#

The Data Dilemma of Web2 and Web3#

In the digital age, data has become one of the most valuable assets. However, there are fundamental differences in how data is acquired, managed, and monetized between Web2 and Web3.

Web2 Data Model: Monopoly-Based Structured Processing#

Web2 relies on centralized architectures dominated by large tech companies such as Google, Facebook, and Amazon. These platforms accumulate user data to optimize products and ad placements while maintaining control over data circulation and monetization. Despite being the creators of data, users lack direct ownership and the ability to profit from it. This long-standing monopolization of data distribution has led to stagnation in the overall ecosystem of the internet.

Agents, as applications of LLM (Large Language Models), will fundamentally transform data processing and user interactions. By enhancing data processing efficiency and increasing the intelligence of output, agents will disrupt user-data interaction paradigms. They shorten interaction paths and allow users to access results directly, significantly boosting productivity. However, this also introduces new challenges in the redistribution of production relationships.

Web3 Data Model: Decentralized Financial Data#

Web3 attempts to grant users sovereignty over their data through blockchain technology and decentralized protocols, ensuring that data value belongs to the creators. However, Web3 still faces multiple challenges, with the most critical being the limited scope of data scenarios. Most interactions revolve around decentralized finance (DeFi), and the data generated originates from blockchain-based financial activities rather than original value creation. In other words, most Web3 projects do not inherently generate productivity but instead rely on continuously absorbing traditional financial data. The dominance of DeFi as the core application in Web3 has led to liquidity concentration and extreme market fluctuations.

Despite these challenges, DeFi remains the most successful on-chain application because it fundamentally solves the issue of multi-party trust mechanisms. This breakthrough in the financial sector is unprecedented and has reshaped token circulation, creating liquidity incentives within trusted economic models.

Agent: The Driving Force of Productivity#

Within the Web3 ecosystem, Agent, as an AI-driven automation system, is becoming a key force in enhancing productivity. By deeply learning and analyzing both on-chain and off-chain data, agents provide users with efficient and automated solutions.

LinkLayerAI believes that for agents to fully unleash their productivity potential, they must interact with LLMs based on a logical and comprehensive data chain. This requires a high level of data completeness and consistency. In traditional Web environments, data is managed and scheduled by multiple departments, making it extremely difficult to access real-time and complete data chains. As a result, agents have not yet realized their full capabilities. Furthermore, structured local data and complete real-time data are fundamentally different; the latter serves as a prerequisite for sustained productivity.

LinkLayerAI leverages agents to enhance on-chain data productivity by applying intelligent data processing and automated analysis to uncover deeper value within blockchain data. The real-time, comprehensive, and immutable nature of on-chain data makes it a critical indicator of Web3 ecosystem activity, with contract-generated data as our primary focus. Through efficient workflows and intelligent analysis tools, we monitor and analyze on-chain transactions, identifying key indicators such as token liquidity flows, holding patterns, and market trends.

By integrating AI algorithms, we perform in-depth token analysis, including market trend predictions, holding concentration evaluations, and arbitrage opportunity discovery. This empowers investors, project teams, and developers with precise data insights, significantly improving Web3’s data utility and decision-making efficiency.

DeFi: The Catalyst for Production Relationships#

DeFi (Decentralized Finance) fundamentally restructures financial systems by replacing traditional institutions with smart contracts, making asset trading, lending, and yield distribution more transparent and efficient.

How DeFi Reshapes Production Relationships#

Trustless Financial Services – Users can engage in lending, trading, and yield generation without relying on banks, brokers, or other intermediaries.

Open Liquidity Markets – Any participant can provide liquidity and earn rewards, maximizing capital efficiency.

Fair Incentive Mechanisms – Tokenomics ensures that users directly benefit from protocol growth.

Global Accessibility – Regardless of geography or identity, anyone can participate without cumbersome KYC procedures.

LinkLayerAI acknowledges DeFi’s many advantages but also identifies its limitations—such as the over-reliance on liquidity-triggering events and the risks of liquidity bubbles, which hinder sustainable growth.

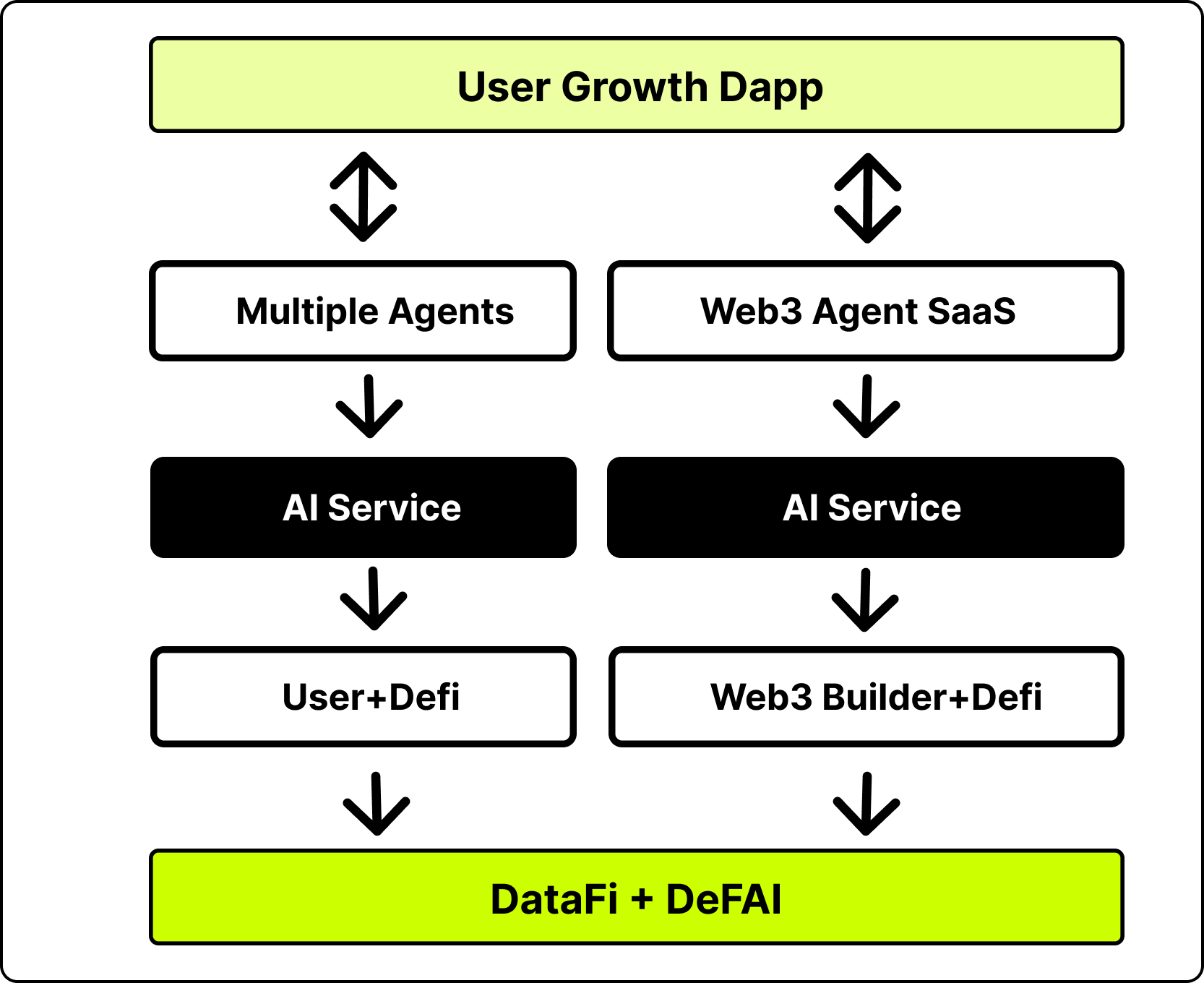

The Convergence of Productivity Data and Trusted Financial Data: Agent + DeFi#

When Agent and DeFiconverge, it is not merely about increasing productivity or optimizing financial systems—it is about establishing a data-driven economic model.

Core Values of Agent + DeFi:#

Enhancing Data Productivity for Intelligent Decision-Making

Agents serve as analytical and execution tools for on-chain data, automating the processing of vast amounts of blockchain information, including token transactions, fund flows, and smart contract calls. Through AI computation and adaptive optimization, Agents can extract valuable insights, providing users with precise market analysis, arbitrage opportunity identification, and liquidity management services. This significantly improves data utilization efficiency and decision-making capabilities in the Web3 ecosystem.

Restructuring Production Relations to Promote Efficient Circulation of Financial Assets

DeFi is fundamentally decentralized finance, and Agents can act as intelligent intermediaries to optimize the DeFi user experience. For instance, in lending, staking, and trading scenarios, Agents can help users automatically select the protocols with the best returns, execute complex cross-chain operations, and lower operational barriers while enhancing fund liquidity and market efficiency.

Automating Interactions to Reduce Web3 Usage Barriers

One of the core challenges of the Web3 ecosystem is the complexity of user interactions. Agents simplify these processes through intelligent automation. For example, users can utilize Agents for one-click cross-chain asset conversion, automated stop-loss and take-profit execution, and smart copy trading, significantly reducing the learning curve for Web3 users and making DeFi more accessible.

Data Assetization: Building a New Value System

By analyzing user behavior, trading patterns, and fund flows on-chain, Agents transform scattered information into tradable digital assets. Integrated with DeFi mechanisms, users can monetize their on-chain data through data asset staking, trading, and authorization, creating new economic value.

Intelligent Incentive Mechanisms for Sustainable Ecosystem Development

The combination of Agents and DeFi enables an economic model based on token incentives. For example, users paying for Agent services may receive partial reimbursement in ecosystem tokens (e.g., LLA), encouraging further engagement. Additionally, data providers, analysts, and liquidity contributors can all receive appropriate incentives, fostering a more dynamic Web3 economic system.

Cross-Chain Coordination for a Unified Multi-Chain Ecosystem

The current DeFi ecosystem faces fragmentation across multiple blockchains. Agents can serve as intelligent bridges between chains, enabling cross-chain data sharing, asset transfers, and smart trading. For example, Agents can automatically identify the best trading routes across different chains, facilitating seamless cross-chain arbitrage and asset management, ultimately enhancing the synergy of the DeFi ecosystem.

LinkLayerAI’s Solution#

LinkLayerAI utilizes Agents to drive on-chain data productivity, applying intelligent processing and automation to extract deeper blockchain insights. By leveraging real-time contract-based data, we provide users and projects with advanced tools for monitoring token liquidity, fund flows, and market trends.

For users, LinkLayerAI offers comprehensive on-chain data analytics, covering market trends, transaction behaviors, liquidity tracking, and wallet analysis, enabling smarter investment decisions.

For projects, we deliver a standardized configuration framework based on project tokenomics and smart contracts, enabling an Agent-powered SaaS model that seamlessly integrates across multiple blockchains to enhance data utility and market competitiveness.

All services are executed via smart contracts, ensuring transparency, fairness, and automation. Moreover, every transaction not only grants access to analytics but also rewards users with LLA tokens, creating a data-driven incentive model. Ultimately, Agent + DeFi bridges users, projects, and on-chain interactions, enabling data tokenization and driving Web3’s decentralized financial evolution.

Conclusion#

Agent + DeFi represents a paradigm shift in Web3—reshaping productivity and production relationships. Agents transform data into assets, enhancing user interaction, while DeFi ensures transparent and efficient financial systems. Their convergence fosters a smart, decentralized, data-driven economy.

LinkLayerAI is pioneering this transformation, making Web3 more inclusive and sustainable through the integration of Agent + DeFi.